Obara Investment Fund I

Fund Overview

- Obara is establishing a $5M real estate investment fund to pursue its investment strategy of investing in emerging neighborhoods, both strategically in opportunity zones and opportunistically throughout Philadelphia.

- The Obara Investment Group I Fund is an excellent opportunity to pursue real estate investment within the Philadelphia market within the context of a professionally managed portfolio approach.

- Will primarily invest in real estate projects with forecasted returns of at least 7% during the holding period and a targeted 18% overall return over the life of the investment

.

A Unique Opportunity

- In the past, Obara raised capital on a project by project basis but the number, size and scope of the opportunities present in the Philadelphia market and COVID-19 pandemic environment demand a more aggressive approach.

-

The Coronavirus pandemic will create unique opportunities to buy properties at a discount

With equity capital and then refinance 75% 90% back out when market equilibrium is restored. - Obara will engage in both small new construction and rehab flips, which tend to have higher returns as well as larger multifamily developments.

- The fund will earn steady monthly income from a portfolio of properties that it will hold for rents and raise overall portfolio returns with an allocation of capital to 6-12 month high return flips.

“Use equity capital to take advantage of distressed sales and foreclosure environment resulting from the coronavirus pandemic to buy properties at substantial discounts and then refinance equity out of properties once market equilibrium is restored. ”

Investment Strategy

- Target city dwellers with quality housing and rentals commensurate to their income and supportive of their lifestyle while generating social returns through the revitalization of neighborhoods.

- Use equity capital to take advantage of distressed sales and foreclosure environment resulting from the coronavirus pandemic to buy properties at substantial discounts and then refinance equity out of properties once market equilibrium is restored.

- Concentrate investment in a select neighborhood to in effect flip the neighborhood in strategically phased tranches of investment, with which each previous tranche of investment acting as the comps for the subsequent investment tranche that can then sell and rent for approximately 10% more than its predecessor.

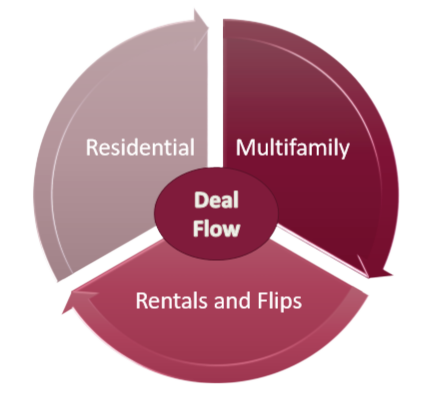

- Target a combination of residential and multifamily properties and generate income streams from both flips and long term holds.

- Pursue a mixture of income producing, upgrade/renovation and ground up development projects to produce superior risk adjusted returns.

Target a combination of residential, scattered site investments, multifamily and mixed use opportunities in the Philadelphia area.

Summary of Terms: Minimum Investment

- Total investment dollars targeted is 5 million dollars

- The Equity offering will be available beginning April 1, 2020 and will continue until the total offering is met or June, 2020, whichever occurs earlier. Obara reserves the right to extend the offering period.

- The fund has a 5-year term.

- Minimum Investment The fund’s minimum investment is $25,000 although the company may accept fractional investment amounts at its discretion. Related investors may pool their money to meet minimum investment level.